Now that would be amusing if California was not the world's 8th largest economy! Setting aside the fact that 26 of the 50 states already have insolvent unemployment insurance trust funds, let's not mess with something as sophomoric as transition and get right to my rant of the day.

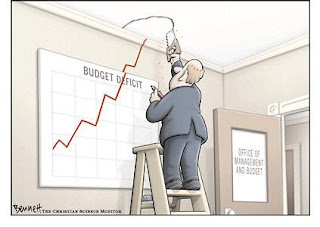

We have a serious white elephant in the corner: the incredible amount of debt that our federal government has accumulated over the years. More specifically, the interest accumulation on that debt. Just like the credit card companies that are now creeping up the interest rates, (somewhat due to the ridiculous CARD act) the holders of our debt (a.k.a. US Treasuries) will at some point demand a higher interest rate. Because, let's face facts, our credit worthiness is not that attractive. Why would they do such a thing you ask? Don't they need our dollars and especially our consumer markets? Well...

We have a serious white elephant in the corner: the incredible amount of debt that our federal government has accumulated over the years. More specifically, the interest accumulation on that debt. Just like the credit card companies that are now creeping up the interest rates, (somewhat due to the ridiculous CARD act) the holders of our debt (a.k.a. US Treasuries) will at some point demand a higher interest rate. Because, let's face facts, our credit worthiness is not that attractive. Why would they do such a thing you ask? Don't they need our dollars and especially our consumer markets? Well...Although China is giving it a run for the money, Japan is the largest single holder of US Treasuries. Between the 2 countries , they own just over 50% of all of our bonds. Has anyone noticed what Japan's debt to GDP ratio is lately? I can tell you, it is not great. So, what is one of the first things you do when you owe somebody money? You call all your friends that you have lent money to and say "hey, I need that $10 I loaned you." Japan is in a financial crisis that has been exacerbated deeply by... wait for it...

YEARS OF STIMULUS SPENDING

Yep. Just like the history shows with FDR and the depression of the early 20th century (still cannot figure out why it is called "great") government's overspending and overinfluencing the free market only makes matters worse. The comparison to FDR was a critical selling point which helped put President Obama into office. However, only the whitewashed, romantic version of FDR was utilized for this purpose.

So what to do you ask? The old cliche about being stuck in a hole... Unfortunately, that may mean banging ourselves in the head with the shovel. Our elected "representatives" (the same one's who are telling us how much we need national health care, even though most of us are dead set against it and have repeatedly told them so) are obviously not going to stop digging. Withholding money from people who are hurting is just not that popular. It also does not get you campaign contributions from large corporations and Carribean vacations on behalf of powerful congressional caucuses.

We need a new way forward. I continue to ask what would prevent Congress from imposing a lobbying ban on themselves? Why would they even need to legislate it. Show some honor and self-govern. I believe there was even once a document written about that.

0 comments:

Post a Comment

Feel free to comment. All civil discourse is welcome (especially dissenting views). I will not moderate. However, if you want to say it, have the guts to put your name to it.